Double Entry System of Accounting Basic Rules and Examples

Every business transaction which can be measured in monetary terms has to be accounted for in the accounting books of the business. In order to record such transactions, a system of debit and credit has to be used, which records each transaction through two different accounts. That is, whenever a business transaction occurs, at least two accounts are always impacted by a debit or credit entry. However, many learners of the basics of accounting get confused while applying the golden rules for debit and credit to some business transactions. Golden rules of accounting are the cornerstone of the entire accounting process.

What are the 5 elements of double-entry accounting?

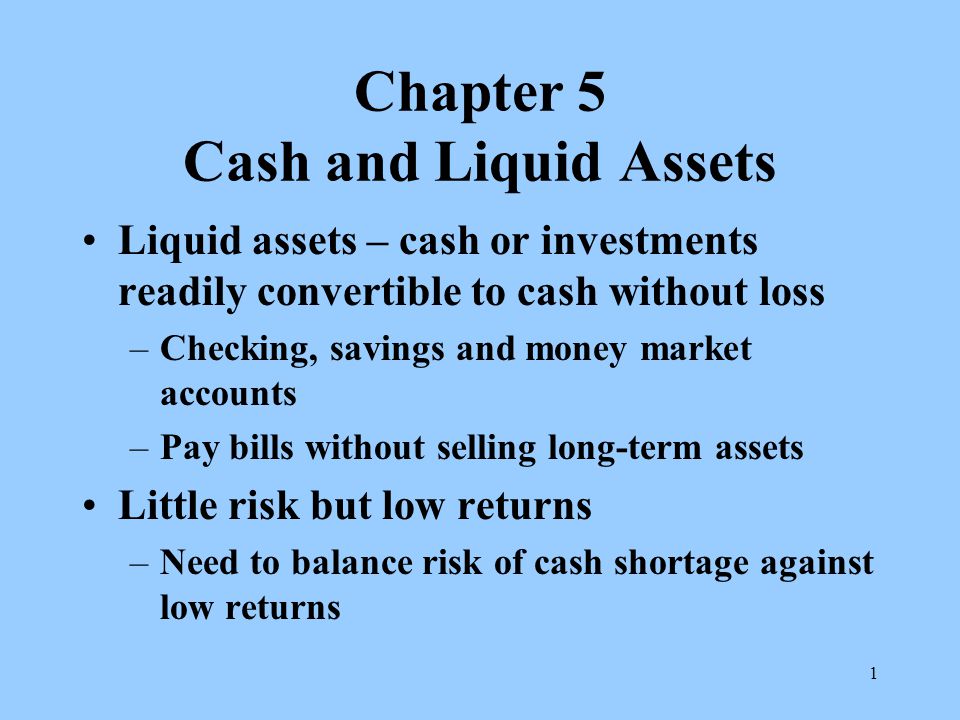

For the purpose of the accounting equation approach, all the accounts are classified into the following five types: assets, capital, liabilities, revenues/incomes, or expenses/losses. If there is an increase or decrease in a set of accounts, there will be equal decrease or increase in another set of accounts.

Nominal accounts are general ledger accounts that are used to track the revenue, expenses, profits, and losses of the business. These accounts are closed at the end of each accounting period and are also called temporary accounts. Hence, nominal accounts include revenue, expense, and profit and loss accounts which are reported on an income statement.

Debit the receiver and credit the giver

Also, a corresponding entry of $2,500 is made on the credit side of the account because the liability to this creditor is increasing. For example, consider the entries resulting from an approved expense claim. The amounts are large, so perhaps the expenses were incurred by a senior manager or just possibly a journalist. Therefore, if you buy a new factory or if you buy some postage stamps, the appropriate accounts will be debited.

As you might expect with the field of accounting, there are some rules that professional accountants needs to follow when performing their duties and tasks. The two aspects of this transaction are that the amount of cash is reduced and assets, i.e. laptop comes into the organization. You need to debit the receiver and credit your (the giver’s) Cash account.

How double-entry accounting works

Whenever expenditure is incurred, you must debit the expenditure account; when income is received you must credit the income account. When cheques of money are received, you debit the cash or bank and credit the person who is paying you. When a company keeps accounts accurately, each and every transaction made by the company will be represented in two or more of its accounts.

- However, what will be the Entry to be made in the books of the business ‘B’.

- A solid understanding of the debit entry accounting system will also help you select the right accounting software for your business.

- This system of accounting is named the double-entry system because every transaction has two aspects, both of which are recorded.

- Every process has a set of rules universally applicable and followed by all.

- Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

- Let’s first understand the role of accounting in a business, to whom it applies, and find out the benefits of good accounting practices that follow these three golden accounting rules.

By providing the basis for recording transactions, these rules help in the systematic presentation of financial statements. Using them, one can easily record expenses and income, thereby facilitating better management of business accounts book. Therefore, you have to credit all incomes and gains and debit what comes in. The “Debit the receiver, Credit the giver” rule is applicable for personal accounts. When a natural or artificial entity makes a donation to a company, it becomes an inflow.

Debit and Credit in Accounting Double Entry System

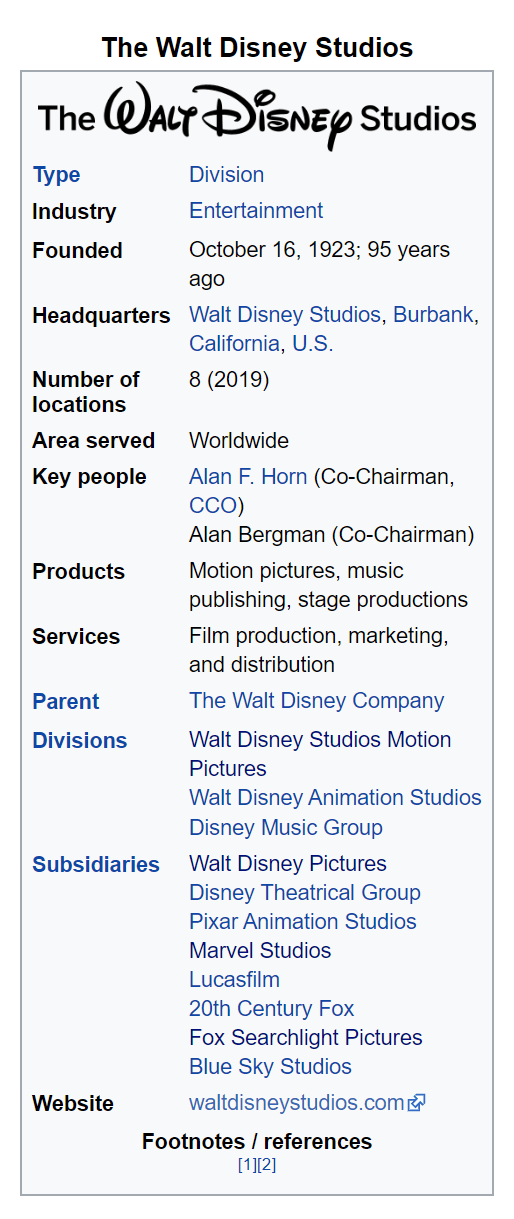

Every corporate entity must present its monetary info to all its stakeholders. The details provided in the financials should be accurate and present a true picture of the business entity. For this golden rules of double entry system discussion, it has to prepare account for all its business deals. Since corporate entities are compared to recognize their financial standing, there needs to be uniformity in accounting and audit.

It also provides an accurate record of all transactions, which can help to reduce the risk of fraud. Since every transaction affects at least two accounts, we must make two entries for each transaction to fully record its impact on the books. One of the entries is a debit entry and the other a credit entry, both for equal amounts. In double-entry bookkeeping, debits and credits are terms used to describe the 2 sides of every transaction.

Preferred by Investors, Banks, and Buyers

If a firm obtains something of value , it is debited in the books in a real account. When something valuable leaves the company, it is recorded as credited in the books. So, get to know the three accounting golden rules that simplify the complicated task golden rules of double entry accounting system of recording financial transactions. The ledger accounts which contain transactions related to the assets or liabilities of the business are called Real accounts.

- Knowing these rules helps you to determine which accounts are increased by a debit (or decreased by a credit) and which accounts are increased by a credit (or decreased by a debit).

- Double-entry bookkeeping produces reports that allow investors, banks, and potential buyers to get an accurate and full picture of the financial health of your business.

- Personal Accounts-Personal accounts relate to persons, trade receivables, or trade payables.

- When you receive the money, your cash increases by $9,500, and your loan liability increases by $9,500.

So, if assets increase, liabilities must also increase so that both sides of the equation balance. The best way to get started with double-entry accounting is by using accounting software. Many popular accounting software applications such as QuickBooks Online, FreshBooks, and Xero offer a downloadable demo you can try. If you’re ready to use double-entry accounting for your business, you can either start with a spreadsheet or utilize an accounting software. By entering transactions properly, your financial statements will always be in balance.

What are the 3 basic rules of double-entry book keeping?

- Every business transaction or accounting entry has to be recorded in at least two accounts in the books.

- For each transaction, the total debits recorded must equal the total credits recorded.

- Total assets must always equal total liabilities plus equity (net worth or capital) of a business.